Financial Wellness

Where do I start?

Creating a spending and savings plan is the groundwork for your long-term financial success. First, you have to be honest with yourself and evaluate where you currently stand in your financial performance.

Ask yourself these questions:

- Do you have a budget? Does it need to be updated?

- Are you in debt?

- Are you spending every dollar you make?

- What are your financial goals? What do you need to purchase in the next month, quarter, year, 5 years?

- What are your spending priorities? What essential items do you have in your budget? What are the non-essential expenses?

- Are you saving? Can you save money anywhere in your budget?

- Do you know your spending habits? Have you ever tracked how you spend your money?

A review of your expenses and spending habits will enable you to design a realistic monthly budget.

- Evaluate. Be honest with yourself. Learn your spending habits. Define your needs and your wants.

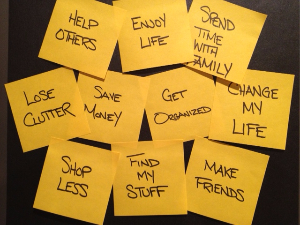

- Set goals for family. Be prepared to make some changes. Sometimes our habits keep us from achieving our financial goals.

- Build a Budget. How? See below.

- Balance your checkbook. Stay on track with your budget by keeping your expenses within the budget you created. Use tools to help you keep up with how you are spending your money.

Click here to access our Online Banking site.

It’s all about the Budget

A budget is a step by step plan for meeting your expenses within a specific time-frame.

Let’s create a spending or savings plan to meet your goals.

- Determine and write down your financial goals.

- Make a list of your income. What money do you earn each month (or weekly)?

- Make a list of your expense categories? How much do you spend each month (or week) in each of these categories?

- Use a budgeting tool such as a Microsoft Excel spreadsheet to document your income and expenses.

- Track your income and expenses by keeping a running total to compare to your budgeted amount for each category.

Use our simple, easy to use excel spreadsheets. You will find some templates to get started plus some examples.

How much should I spend in each expense category? Here are our recommendations.

Categories & Guideline Percentages

- Housing: No more than 35%

- Savings: At least 10%

- Transportation: No more than 15%

- Debt: No more than 15%

- Other: No more than 25%

Balanced Checkbook

Creating a spending and savings plan is the groundwork for your long-term financial success. Cultivating habits to balance your spending plan includes keeping track of the money that goes in and out of your account(s), comparing it to your budget category distributions, spending appropriate amounts of money (living within your means), and more.

How do you track your spending?

Do you check your checking account statement from the bank each month? Or do you check your internet banking site to see what has cleared your account? Either tool is a great way to ensure your account is accurate.

Click here to download a simple Microsoft Excel spreadsheet that allows you to enter your checking account transactions and keep a running balance using the formulas already built for you. As well, you can enter the amounts in your budget categories to compare the dollars you spend with the dollars you allocated for each category.